operating cash flow ratio ideal

The formula to calculate the ratio is as follows. An operating cash flow margin is a measure of the money a company generates from its core operations per dollar of sales.

Operating Cash Flow Ratio Formula Guide For Financial Analysts

Ad Forecast your future cash position and gain your control on your business finances.

. Ad Free Cash Capital Course Accredited By The Chartered Institute Of Management Accountants. Rated the 1 Accounting Solution. Operating Cash Flow Margin.

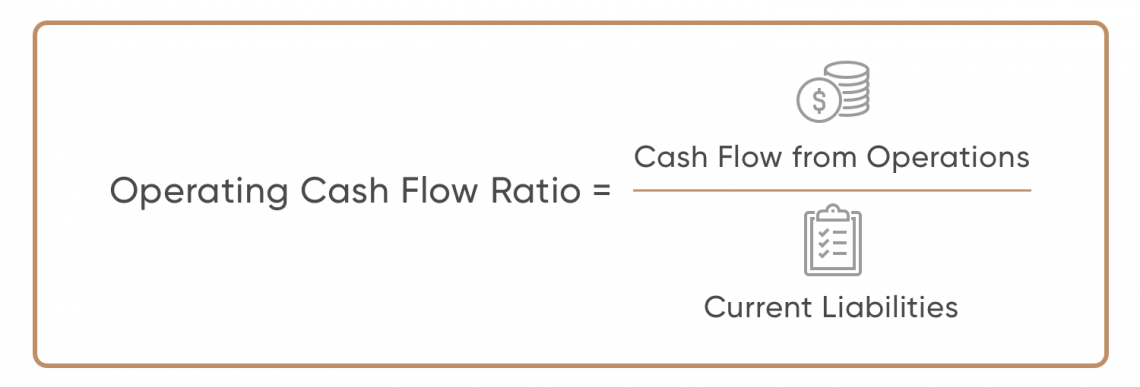

Operating cash flow measures cash generated by a companys business operations. OCR Ratio Cash flow from operating activities Current liabilities. Put simply its a.

Cash Flow-to-Debt Ratio. The operating cash flow ratio is a measure of how well current liabilities are covered by the cash flow generated from a companys operations. Operating Cash Flow - OCF.

Recognized And Prize-Winning Courses Provided Online And For Free - Since 2007. Test multiple scenarios generate accurate forecasts and enforce your chart of accounts. However we do not use the most liquid money and assets currently held by the company.

Ad Integrate book keeping with all your operations to avoid double entry. Ideally your operating cash flow ratio should be fairly close to 11 meaning you make 10p per 1 you. Example of Cash Returns on Asset Ratio.

The operating cash flow ratio is a measure of a companys liquidity. 872 975. This ratio is similar to the cash ratio.

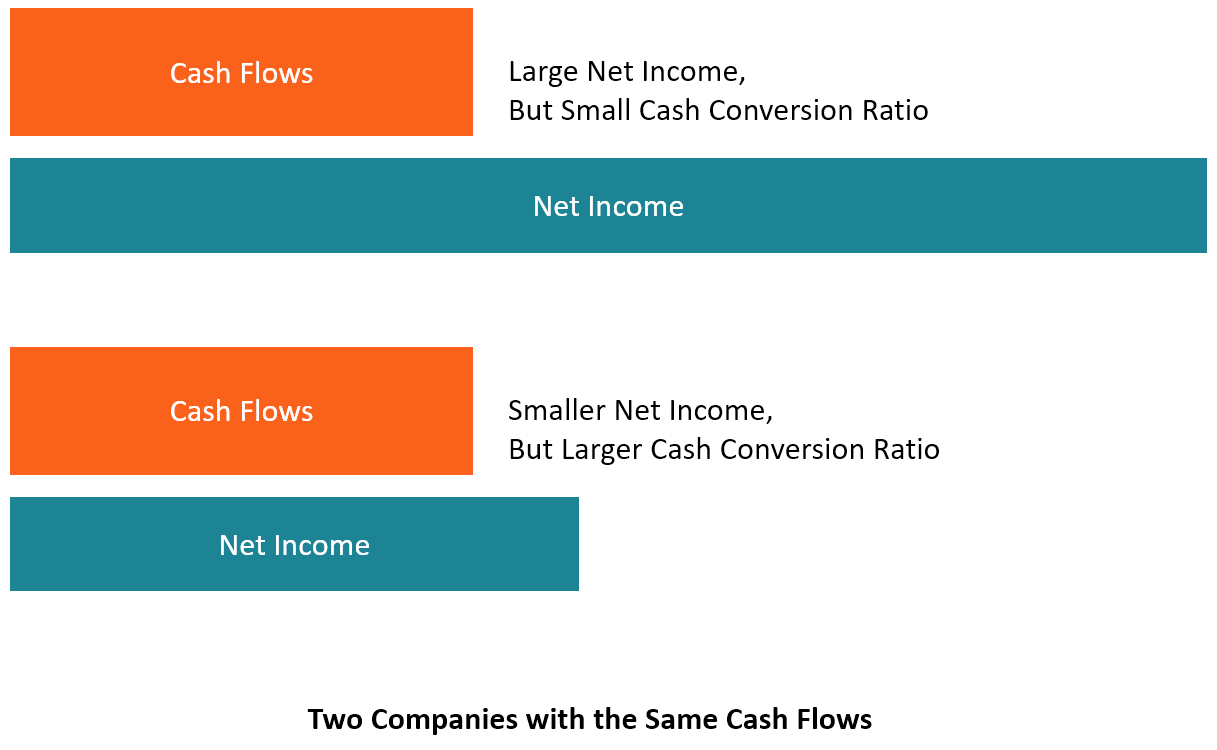

In an ideal situation when sales revenue increases cash flow should. A high cash conversion ratio indicates that the company has excess cash flow. Try for Free Today.

Since the ratio is lower than 1 it indicates that Bower Technologies has a weak financial standing or is. Ad Customized Cash Flow Management Solutions From MT Bank. Similarly current account savings account CASA ratio of bank grew 270 basis points year-on-year to 42 during the September quarter.

CCR is a quick way to determine the disparity between a companys cash flow and net profit. Ad The Key To Success Is Gaining More Control Over Cash Flows. Operating cash flow indicates.

Ad With a Focus on Client Goals American Funds Takes a Different Approach to Investing. Find The MT Bank Cash Management Solutions To Fit Your Financial Needs. Free cash flow is the cash that a company generates from its business.

The cash flow-to-debt ratio is the ratio of a companys cash flow from operations to its total debt. HSBC Can Help You With That. Operating cash flow ratio.

A ratio of 11 is considered ideal. The operating cash flow ratio also known as a liquidity ratio is an indicator which helps to determine whether a company is able to repay its current liabilities with cash flow coming. Cash returns on assets cash flow from operations Total assets.

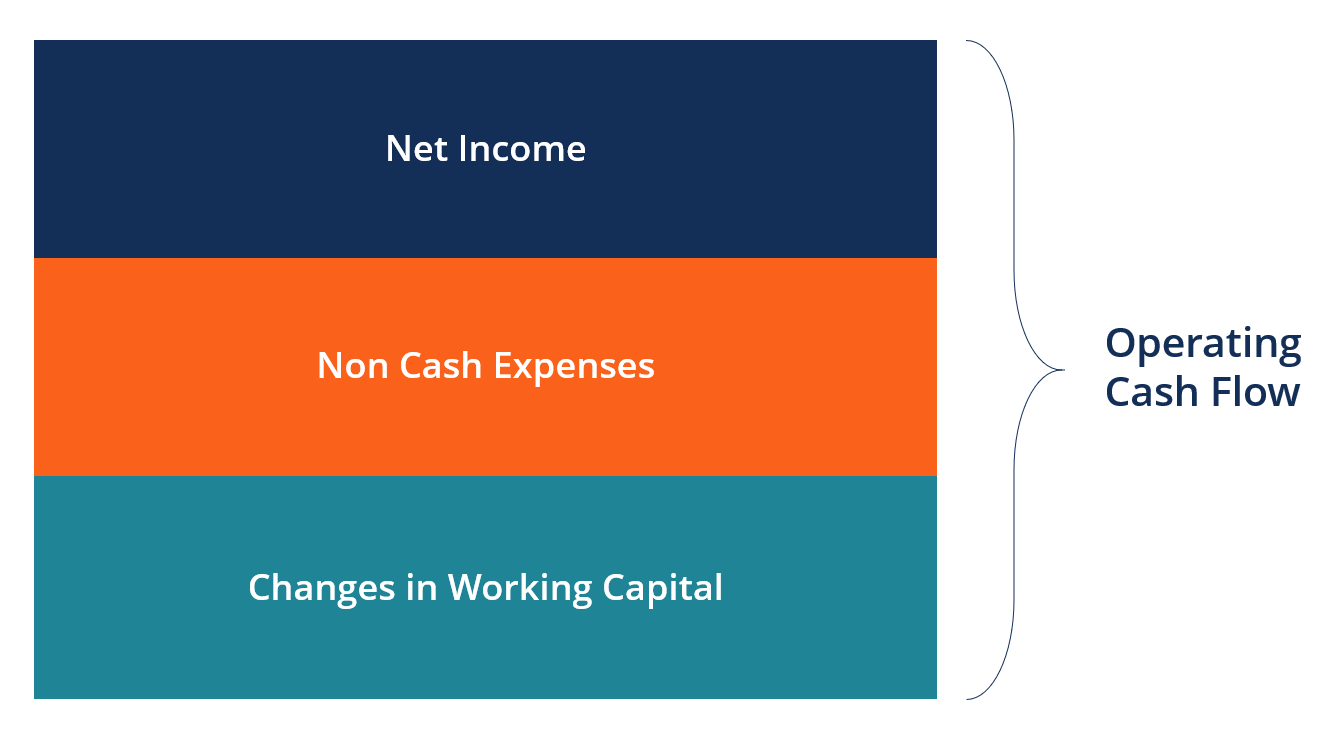

Learn More About American Funds Objective-Based Approach to Investing. Operating cash flow is a measure of the amount of cash generated by a companys normal business operations. This ratio is a type of coverage ratio and can be.

Operating cash flow margin is a profitability ratio that measures your businesss cash from operating activities as a percentage of your sales revenue over a given period. The operating cash flow to sales ratio is a popular metric used to compare current cash flow against sales revenue. If the operating cash flow is less than 1 the company has generated less cash in the period than it.

The price-to-cash-flow ratio is a stock valuation indicator that measures the value of a stocks price to its cash flow per share. Ad QuickBooks Financial Software. Ad Forecast your future cash position and gain your control on your business finances.

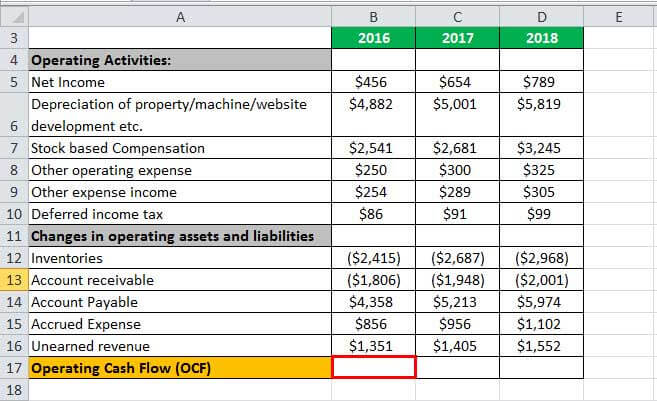

Lets consider the example of an automaker with the following financials. Operating cash flow Net cash from operations Current liabilities. Operating Cash Flow Ratio.

Speak To An HSBC Representative To Learn More About Our Commercial Banking Services. Automate your vendor bills with AI and sync your banks. Each ratio reveals a specific financial aspect of the company.

Test multiple scenarios generate accurate forecasts and enforce your chart of accounts. They use some ratios more frequently used than others depending on the business and its financial needs. The Operating Cash to Debt ratio is calculated by dividing a companys cash flow from operations by its total debt.

Operating Cash Flow Ratio Definition And Meaning Capital Com

Price To Cash Flow Formula Example Calculate P Cf Ratio

Operating Cash Flow Margin Formula And Calculator

Cash Flow To Debt Ratio Meaning Importance Calculation

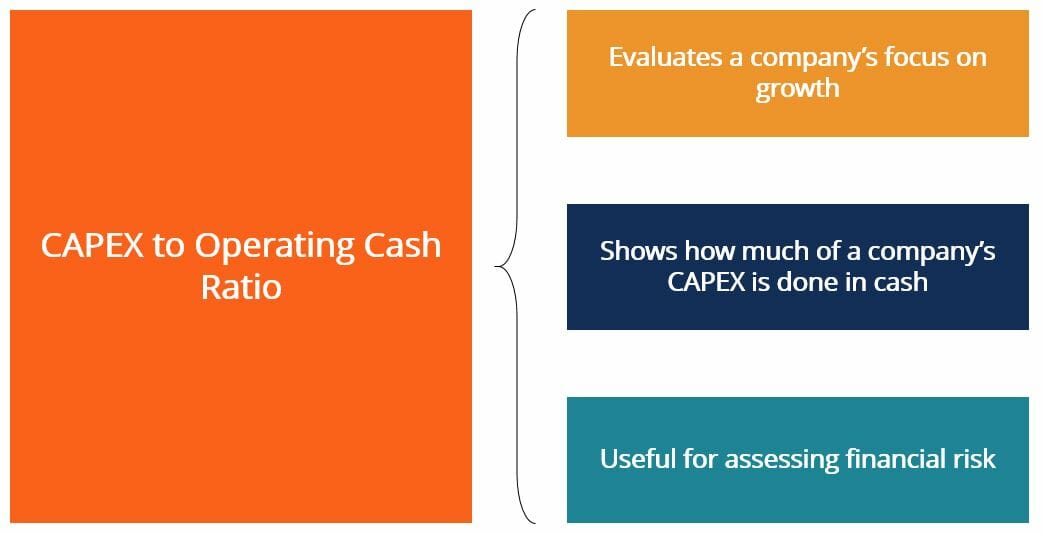

Capex To Operating Cash Ratio Definition Example Corporate Finance Institute

Operating Cash Flow Formula Calculation With Examples

Cash Flow Formula How To Calculate Cash Flow With Examples

Price To Cash Flow Formula Example Calculate P Cf Ratio

Cash Conversion Ratio Comparing Cash Flow Vs Profit Of A Business

Free Cash Flow Formula Calculator Excel Template

Price To Cash Flow P Cf Formula And Calculator

Price To Cash Flow P Cf Formula And Calculator

Cash Conversion Ratio Financial Edge

Operating Cash Flow Formula Overview Examples How To Calculate

Operating Cash Flow Formula Calculation With Examples

Cash Flow From Operations Ratio Formula Examples

Operating Cash Flow Formula Examples With Excel Template Calculator